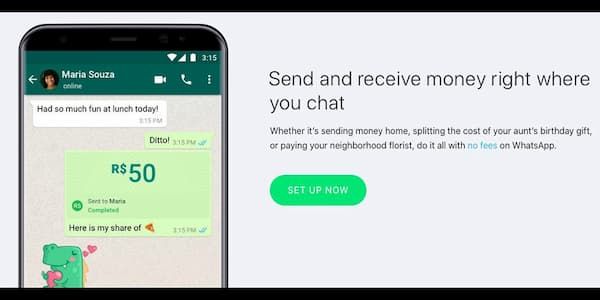

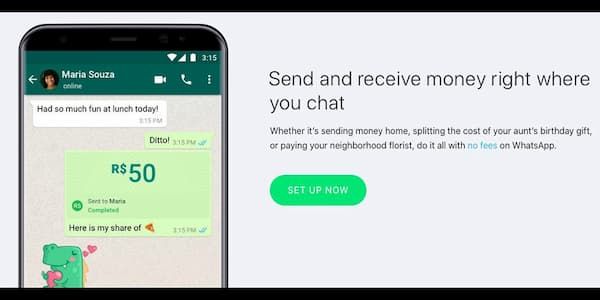

Finally, the Facebook-owned messaging platform WhatsApp gets the required permission to roll out digital payments in India. In a significant move, the WhatsApp Pay clears all the regulatory and legal hurdles to offer UPI-based mobile payments.

The WhatsApp got a Go-Live clearance from Reserve Bank of India and thus National Payments Corporation of India (NPCI) too approved WhatsApp Pay to start its services in a graded manner.

As per the condition, the WhatsApp can expand its UPI user base with a cap of 20 million users in the first phase. Moreover, it can handle only a max of 30% of overall UPI transactions.

This capping of 30% will be applicable for a period of 2 years.

UPI Payments – The Big Four:

To the unaware, the UPI-based digital payments in India are currently controlled by the Big 4 tech giants. These include GooglePay, Walmart’s PhonePe, Alibaba-backed Paytm, and Amazon Pay.

As per the Industry experts, Google Pay with over 40 per cent share is the market leader. Facebook with WhatsApp Pay service has been trying for a long time to make its entry into this UPI ecosystem.

Starting November 2016, India witnessed a phenomenal growth in digital payments following Narendra Modi’s announcement of demonetizing high-value currency notes.

A Big Boost to Reliance JioMart:

Though Google Pay dominates the UPI-based digital payments market, there’s a definitely a place for WhatsApp Pay. The messaging platform has a solid base in the Indian market with more than 380 million users.

Moreover, the Jio is also betting big on WhatsApp to carry its ambitious e-commerce forays through JioMart. To the unaware, Facebook has about a 9.9% stake in Reliance Jio platforms.

Do you agree with my opinion? Share your thoughts.

Also Read: Jio Allies with UK’s AeroMobile for In-Flight Service (Postpaid Plus)